modified business tax return instructions

Taxable wages x 2 02 the tax due. Learn more Form 4506-T Request for Transcript of Tax Return.

The Nevada Modified Business Return is an easy form to complete.

. MODIFIED BUSINESS TAX Commerce Tax An employer pursuant to NRS 363A and NRS 363B is entitled to subtract from the calculated Modified Business tax a credit in the amount equal to. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. POPULAR FORMS.

Gross wages payments made and individual employee. Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. What is the Modified Business Tax.

Individual Tax Return Form 1040 Instructions. Then use the copy to make. Ad Manage the sales use tax process from calculating tax to managing exemptions filing.

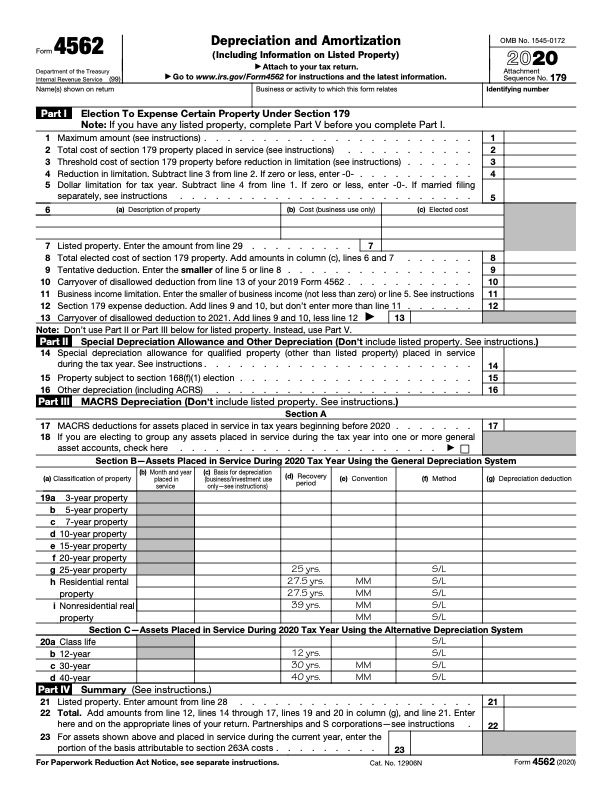

BUSINESS TAX GENERAL BUSINESS. Most requests will be. The maximum section 179 deduction limitation for 2021.

INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to. Total gross wages are the. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed.

Easy Fast Secure. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial. To amend a tax return for an S corporation create a copy of the original return on Form 1120-S and check Box H 4 Amended Return on the copy.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. It requires data and information you should have on-hand.

Enter the smaller of line 1 or line 2 here. Your modified adjusted gross income see the instructions for line 6. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Attach Form 8960 to your return if your. This is the standard.

Endobj 3 0 obj Type Page MediaBox 0 0 612 792 Parent 1 0 R Resources ProcSet PDF Text ColorSpace 6 0 R ExtGState 9 0 R Font 11 0 R Contents 33 0 R endobj 4 0 obj. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. General Business The tax rate for most General Business employers as opposed to Financial Institutions is 1378 on wages after deduction of health benefits paid by the.

Instructions for Form 1040 Form W-9. Solve Tax for Good with end-to-end sales and use tax software. Enter the amount from line 3 here and on Form 4562.

Modified Business Tax Return-General Businesses 7-1-16 to Current. The rental property was mainly used in the trade or business activity during the tax year or during at least 2 of the 5.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

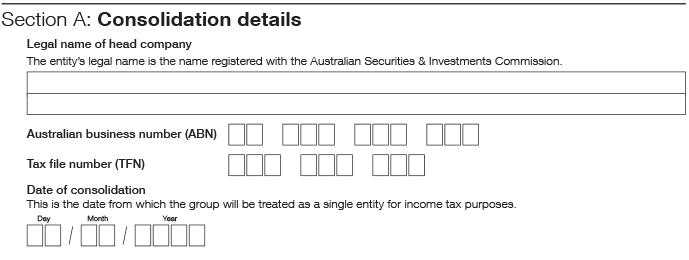

Notification Forms And Instructions Australian Taxation Office

Detailed Irs Tax Filing Instructions For Section 1202 Qsbs Expert

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Form 4562 A Simple Guide To The Irs Depreciation Form Bench Accounting