tax benefit rule state tax refund

If an amount is zero enter 0. His state income tax refund is partially includable.

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

If an amount is zero enter 0.

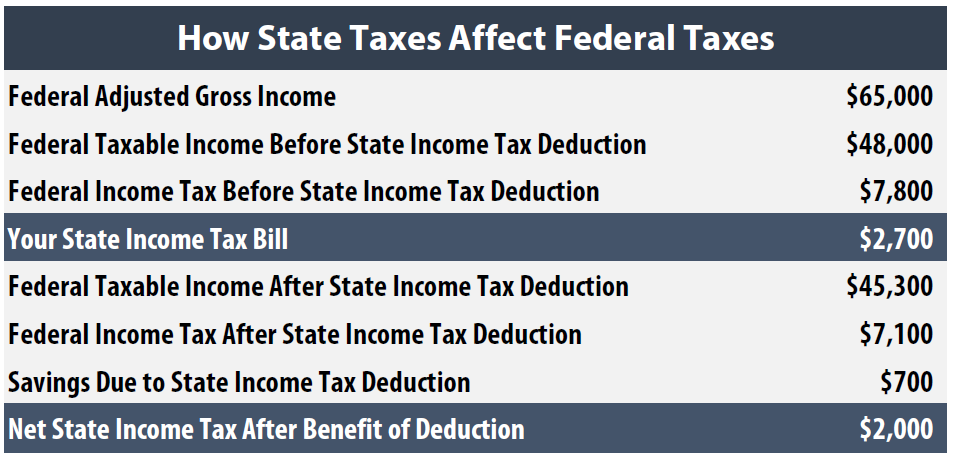

. State tax refunds are only SOMETIMES taxable on the 1040. If there is a difference follow the steps above to enter the part of the refund that had no tax benefit. Basically the rule are set such that you cant game the system by taking a big deduction on state taxes overpaid in year.

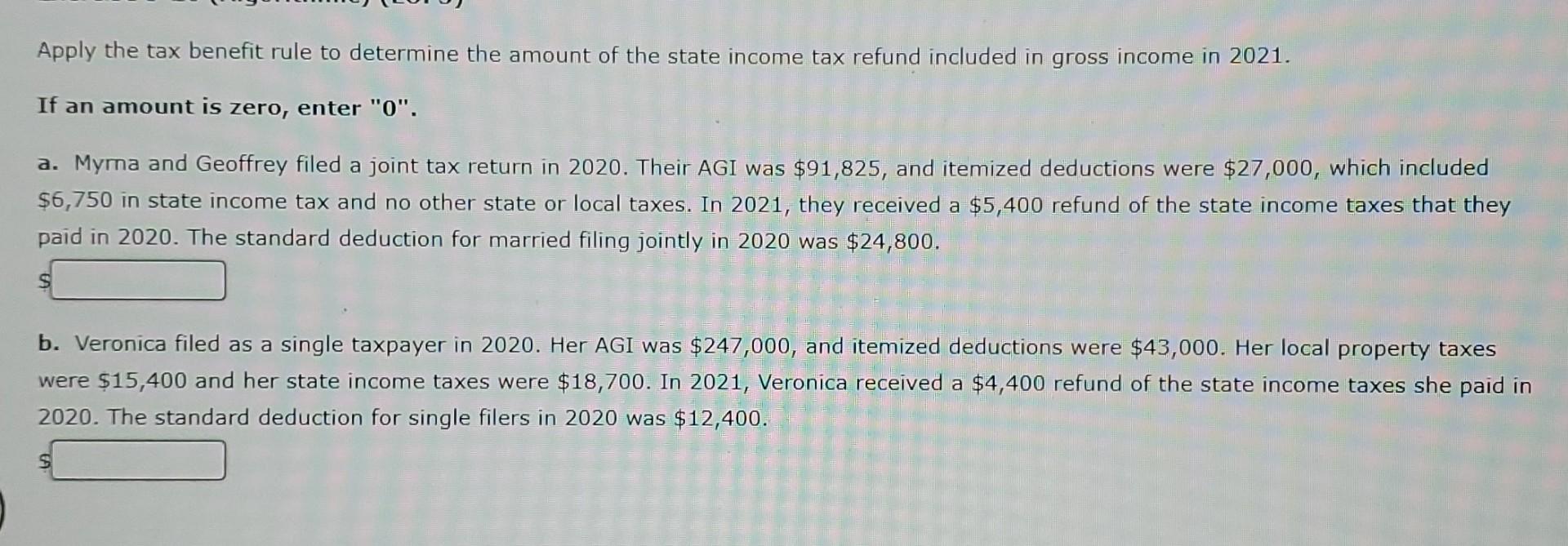

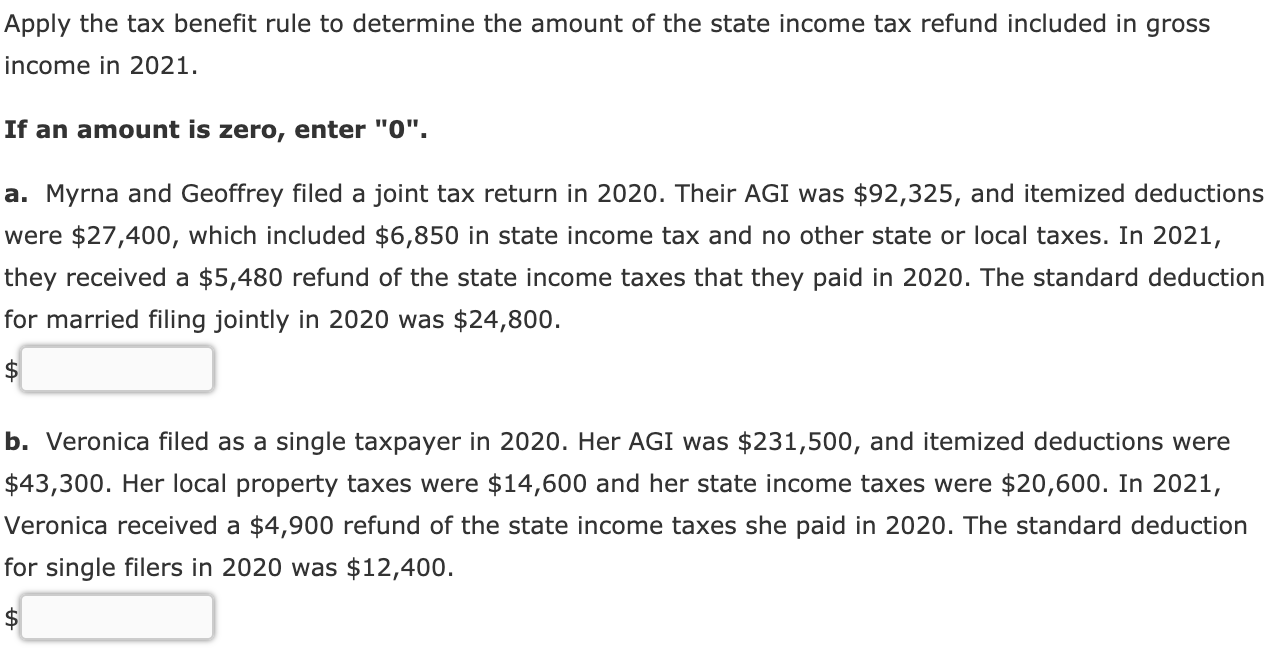

Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022. One common source that is frequently overlooked by tax advisors and more often misunderstood is the application of the tax benefit rule IRC section 111 to state and local tax. Apply the tax benefit rule to determine the amount of the state income tax refund included in gross income in 2022.

Enter the refund as income then back it out As per. A rule that provides that the amount of an expense recovered must be included in income in the year of the recovery to the extent the original expense resulted in a tax benefit. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750.

Myma and Geoffrey filed a joint tax. Refunds of amounts deducted on a 1040 -- usually these are state income tax refunds but they can be refunds of other taxes or other expenses like medical -- are not. 1500 refund of state income taxes paid in 2018.

Tax Benefit Rule of 111 Should Shield State Tax Refunds For Taxpayers Over the SALT Limit. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Had Chris withheld only the exact amount of state income tax.

It shouldnt but it is not programmed like the 1040. The original return had taxable income of 50000 with total tax of. In 2019 he received a 1500 state income tax refund.

However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier. Had A paid only the proper amount of state income tax in 2018 As state and local tax deduction would have been reduced from 9000 to. Under the tax benefit rule the state refund is only deductible up to the point where you get a tax benefit from deducting it.

When the couple paid the excess refund 400 to the. Myrna and Geoffrey filed a joint tax. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the deduction taken for the refunded amount reduced tax in the earlier.

March 01 2019 by Ed Zollars CPA. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus. Let me try and parse this out.

This week a number of questions arose in.

1040 2021 Internal Revenue Service

Under New Law Is A 2018 State Tax Refund Received In 2019 Considered Taxable Income In 2019

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

How State Tax Changes Affect Your Federal Taxes A Primer On The Federal Offset Itep

Taxes On Social Security Benefits Kiplinger

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Irs Publishes Guidance On Interplay Between 10 000 Salt Cap Tax Treatment Of State Tax Refunds

Tax Treatment Of State And Local Tax Refunds

Effects Of Tcja On Salt Refunds

How To Get A Full Tax Refund As An International Student In Us

Tax Aide State Local Income Tax Refunds Form 1040line 10 Pub 4491page Ppt Download

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

Where S My Refund Track My Income Tax Refund Status H R Block

What Is Adjusted Gross Income H R Block

Corporations Avoid Tax Bills Despite Reform Efforts The Washington Post

It S About Your Total Tax Liability Not Your Refund Tax Policy Center